February 10, 2026

Places for People Homes Ltd v HMRC: treatment of residential service charges

A VAT case with major implications for UK landlords, management companies, maintenance trust companies and residential estates.

February 10, 2026

What could the new CASS Assurance Standard mean for EMIs?

When the FRC's CASS assurance standard is revised to bring CASS 15 into scope, how will this impact senior management?

February 5, 2026

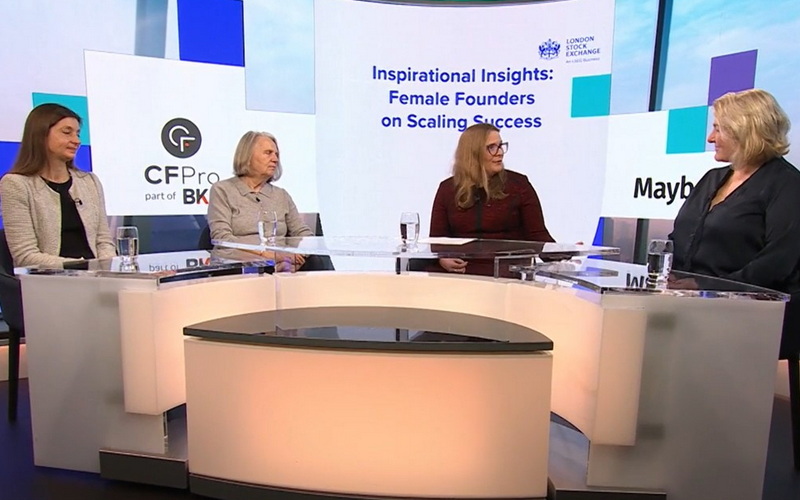

Female founders on scaling

One conversation, two perspectives. How structure, speed and the right support help female founders scale with confidence.

February 4, 2026

TSI Instruments v HMRC: import VAT on after-sales repairs

In confirming a key point about input VAT recovery by the person importing the goods, this Tribunal decision left the company with a £8.5m import VAT cost.

January 30, 2026

Remote working and Permanent Establishments: clearer guidance for employers

Can remote work create a permanent establishment? The OECD's 2025 update brought clarity regarding cross-border tax risk.

January 29, 2026

The Moment – January 2026

The Moment - January 2026 Bringing you our latest insights and updates.

January 28, 2026

Exemption of healthcare from VAT: is a diagnosis actually necessary?

Does the healthcare exemption from VAT apply to cosmetic treatment? Illuminate Skin Clinics Limited v HMRC (2025) gave helpful guidance.

January 28, 2026

Smart Property Investment in a Changing Market

Event: Smart Property Investment in a Changing Market: Tax Efficiency Meets Investment Strategy

January 22, 2026

Your first CASS 15 audit: helping you prepare for the new rules

Requirements under CASS 15, key aspects of the requirements, and our checklist to help ensure you’re CASS 15 ready.

January 22, 2026

Building a home studio: understanding the tax implications

Guidance for entertainers on the tax consequences of paying for and owning your home studio.

January 21, 2026

Hippodrome and VAT partial exemption: standard method or only method?

Hippodrome v HMRC (2025) reinforced the difficulty of convincing HMRC to approve partial exemption special methods (PESMs) to calculate residual input VAT recovery.

January 18, 2026

Indian bank interest: the UK tax consequences

Guidance on the UK tax implications of any Indian bank account interest received, and your responsibility to disclose this income to HMRC.